Economy

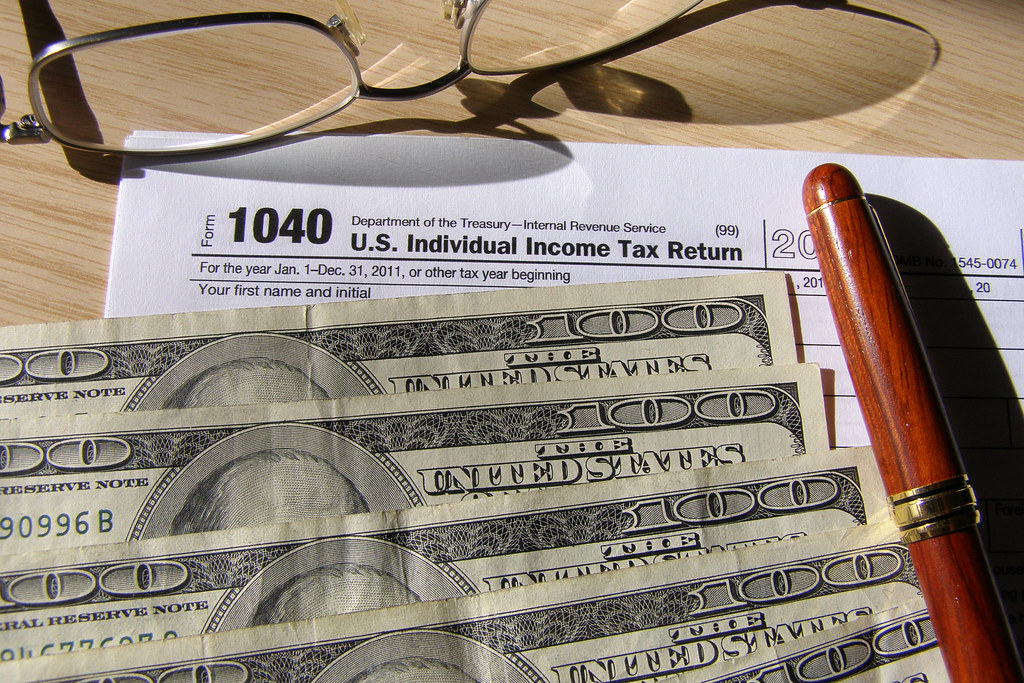

Do You Think That The Current Federal Tax Rate Is Too High?

Do You Think That The Current Federal Tax Rate Is Too High?

Here’s The Scoop

The current federal tax rate has become a burden on hardworking Americans who are struggling to make ends meet. With rates reaching upwards of 37%, it is clear that the government is taking more than its fair share from the pockets of everyday citizens. This excessive taxation stifles economic growth and inhibits job creation, leaving many Americans feeling the weight of an overreaching government.

Not only is the current federal tax rate too high, but it is also unfair. The burden falls disproportionately on the middle class, who are already struggling to keep up with rising costs of living. Meanwhile, the wealthy and well-connected find loopholes and deductions to avoid paying their fair share. This system only perpetuates income inequality and hinders upward mobility for hardworking Americans.

It is time for a change. Lowering the federal tax rate would provide much-needed relief to American families and stimulate economic growth. By allowing individuals and businesses to keep more of their hard-earned money, they will have the opportunity to invest, spend, and create jobs. It is time to prioritize the prosperity of the American people over the bloated government bureaucracy.

What do you think? Let us know by participating in our poll, or join the discussion in the comment section below!

Old Man

October 28, 2023 at 8:19 am

The 2.91% “No” voters must be government employees.

Tarheel

October 28, 2023 at 8:41 am

It’s high because our nation is broke, it’s broke because we spend to much money. What is really infuriating is the fact the money is being spent on other countries. When one is in horrible debt,…one doesn’t sign on to pay a neighbor’s debt as well. Plus the fact our govt wants to either pay people who do not work or write off debt from contractual agreements. There is NO accountability.

Denise

October 28, 2023 at 10:09 am

It’s too high on the lowest earners of the country. It’s far too low on the highest earners. Years ago, when the top tax rates were in the 80% range, things were better. The wealth hoarders need to start providing the resources back into the economy. If they are business owners, give them the option – pay your employees a lot more, or pay far more taxes. Either way, people shouldn’t be allowed to hoard obscene amounts of resources.

Treeminer

October 28, 2023 at 3:31 pm

The Federal Government should ce “LIMITED.” Need to eliminate most Federal employees ans Federal contractors. Taxes should not be based on earnings. A high income earner or a business should not responsible for supporting welfare recipients and social programs. Should go to a flat tax where if earn a $1000 per year or a billion per year everyone would pay a flat 10%. Or go to a national sales tax and eliminate the majority of the IRS.

Tarheel

November 16, 2023 at 7:52 am

So your solution is to punish people that have worked hard, built businesses, hired people, given money to charities rather than our wasteful and inefficient government that every year gives billions away to crooks, other countries, and politicians building bridges to nowhere. Our govt gave billions away to Covid cheaters with NO oversight. The same is true for many govt programs. I get livid when I hear about FREE MONEY from some govt program. It’s not free, we the taxpayers are footing the bill. Our government seems to be run like an 8 yr. Old with a no limit credit card.

RW LAMB

October 28, 2023 at 11:56 am

Flat rate of 10% for all people regardless of whether they make a dollar or 100 billion. I do not believ we the rich should be punished for making money any more than I believe half should pay no taxes. There would b d no loopholes and the only exemptions would be for public service like military, EMT, police, firefighters, etc. This does not mean politicians. If a doctor or orher medical agrees to work in a high need area, they could also get an exemption. Everyone would pay on any income regardless of income level.

SHRW

October 28, 2023 at 12:34 pm

The government must cut out frivolous spending and learn to live within its means. A flat rate would be preferred tax method in that the more a person earns, the more tax they pay. Or a sales tax where we only pay a tax on what we spend. The more we spend the more tax we pay.

Big Ed

October 29, 2023 at 12:40 am

This is the next big screw up. They just announced that we seniors will get a COLA adjustment of 3.5%, but by the end of the year, they might add i% more. We should be getting 15%, because prices won’t stop going up. In Walmart, this week, the tag on the shelf reads a high price of $9.97 for a certain pharmacy item, but at checkout, I had to pay $13.97 for the item. I should have gotten it for free! They can’t change the prices fast enough. Remember, Joe Biden hates Seniors, and Blacks. Every democrat in office should get exploding hearing aids for Christmas They don’t listen to us anyway.

Kennon C Domingue

April 25, 2024 at 12:16 pm

Should be a flat rate across the board, no matter how much you earn a flat rate is only fair to all except for the people who have worked hard and made wise investments and they have to be penalized and pay a higher rate so people who don’t want to work and multiply like rabbits and illegals can get benefits that they don’t deserve. If you support illegals and parasites then you would be mandatory forced to contribute 50% of your net income to support them.